Accounting

Grows your business – you can run your business more efficiently from project management to invoicing. Sage also offers scalable plans so the software grows with your business. Do you think of your ERP software as a smart investment? How about one that continues to appreciate in value—generating long-term returns? Sage Intacct is proving to be that kind of investment for the more than 13,000 companies that rely on it.

What Does Research Show About Sage?

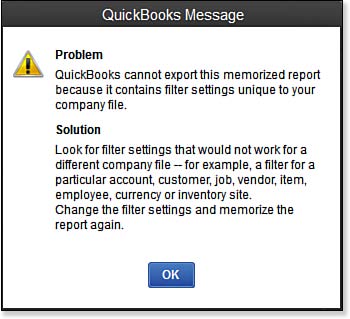

The QuickBooks Conversion Tool right inside your QuickBooks software allows a straight-forward way to convert data directly from your current program to QuickBooks. Join the Xero partner programme for access to free training, dedicated account management and online software for your practice. Plus get what you need to help clients be more productive, more efficient and more profitable. When you have a monthly or annual subscription with QuickBooks Desktop, upgrades come free of charge and are sent as soon as the option to upgrade becomes available. Access to QuickBooks Desktop 2020 started in fall 2019, so you would have received an email with new license information and a download link to get started in 2020.

Terms, conditions, features, pricing, service and support are subject to change without notice. Accessible from mobile, desktop and tablet from anywhere. Started with enterprise edition and switched to online edition. Intacct was founded by Odysseas Tsatalos and David Thomas bookkeeping in 1999 as one of the first accounting applications for the cloud. The company was headquartered in San Jose, grew organically and offered a suite of accounting software that could serve medium and large-sized businesses with consolidated ERP, and e-commerce features.

By Accessing And Using This Page You Agree To The Terms And Conditions.

How many employees does Sage have?

Run your business from the cloud QuickBooks free cloud accounting software keeps your data safe and accessible on the go. In the office, at home or on the road, you can run your business anywhere and on any device.

It relieves us of the burden of maintaining a network or an IT guy, we’re told. Cloud applications allow us to access our data now from anywhere, using just about any mobile device.

And, we’re told, monthly software payments help us with our cash flow. Companies use NetSuite for enterprise resource planning (ERP) and to manage inventory, track their financials, host e-commerce stores and maintain customer relationship management (CRM) systems. This flexible platform can be applied to a range of business applications.

Sage Intacct, Inc, previously known as Intacct Corporation, is an American provider of Financial management and services. The company was founded in 1999 and it was acquired by The Sage Group PLC for $850 million in 2017. Its products offer cloud-based accounting applications that enable business payments, manage and pay bills, and facilitate payroll functions. User-friendly cloud-based accounting software that provides users the ability to manage their business from just about anywhere. From the General Ledger to their Cash Management applications, Intacct has become a critical tool for the success of our company.

Organizational users can subscribe directly through the developer. Or, users can subscribe via a network of authorized value-added resellers, who offer additional consulting and support services to complement product functionality. Under the license agreement, all software users fully own their own business data held within the software. The end-user agreement also includes a provision to make business data available for 90 days after service contract termination. Terms, conditions, pricing, subscriptions, packages, features, service and support options are subject to change at any time without notice.

The upgrade is needed to keep the updates compatible with the software. We want to ensure our users are getting the most accurate calculations for their data to avoid potential costly errors down the line. months of service, starting from date of enrolment, followed by the then current monthly price. Your account will automatically be charged on a monthly basis until you cancel. Offer cannot be combined with any other QuickBooks Online offers.

Its web-based applications are built on top of its internally developed platform. Sage Intacct’s application includes accounts payable, accounts receivable, cash management, collaborate, general ledger, order management, purchasing, and reporting and dashboards. Intacct is a cloud-based https://www.bookstime.com/articles/sage-intacct inventory solution that is as easy to use a Quickbooks with the functionality of mid-range accounting software. We moved from Dynamics GP to Intacct almost 2 years ago and love its ease of use and reporting capabilities. It sure made this year’s audit go smoother than ever before.

First released in 2000, Sage Intacct is one of the pioneer SaaS accounting solutions. Over 10,000 organizations now actively use the program.

- Sage Intacct is a provider of cloud-based financial management and accounting software.

- Sage Intacct’s software solution is suitable for small to midsize accounting firms and can provide financial reporting and operational insights as well as the ability to automate critical financial processes.

Intacct is an easy and very effective accounting software to use. I use it to check status of invoices and I use it for my collection notes. Purchasing automates your purchasing transactions and provides a comprehensive set of dashboards and reporting tools for your staff to monitor and manage merchandise sage intacct pricing and services acquisitions. Streamline your quote to cash process across sales, services and finance with MAX for QuickArrow or MAX for OpenAir. Comply with Regulations and Standards – Sage Intacct is certified by nationally recognized auditing firms as GAAP, Sarbanes-Oxley, FASB, IASB and IFRS compliant.

Users can create reports that support non-financial data such as rooms per hotel or tables per restaurant, allowing real-time operational reporting of room occupancy or tabletop management. You can report on earnings per share, or revenue per employee – the numbers you really need to manage, not just the numbers available from your financial system. You can easily calculate performance against plan, against benchmarks, or against other divisions or locations. Sage and QuickBooks are the two most popular accounting software packages for small but fast-growing businesses.

A monthly subscription for QuickBooks Online Essentials (the most popular choice, according to Intuit) lists for $26.95 per month. The application compares closely to the $300 version of QuickBooks Premier. In just one year you’re paying $323 for QuickBooks Online Essentials.

It provides an alternative choice for businesses that require more functional sophistication than what is found in entry-level web accounting products. Growth-minded small and mid-market companies seeking robust financial management capabilities represent the What is bookkeeping core market. Thanks for sharing your concerns about upgrading in relation to the QuickBooks Desktop payroll service add-on. You’re correct that upgrades are required in order to have continued access to the latest payroll tax table updates from the CRA.

Sage Business Solutions is a wholly owned subsidiary of The Sage Group plc, an international company specialising in accounting, payroll and CRM software applications. With operations throughout the UK, Europe, North America, Australia, Asia and South Africa, the Sage Group has an installed customer base of over 7.1 million small and medium-sized businesses around the globe. NetSuite https://www.bookstime.com/ software is an online service that enables companies to manage all key business processes in a single system. The service involves no hardware, no large and upfront license fee, no maintenance fees associated with hardware or software, and no complex set ups. With the QuickBooks ProAdvisor programme, we do have direct access to the level two team whose knowledge is a bit better.

Steps For Burning Sage

Does Sage integrate with QuickBooks?

Poor air quality may be linked to various health conditions. In this way, burning sage is seen as a cost-effective way to purify the air (to an extent). This is because sage is thought to have antimicrobial properties that help kill bacteria, viruses, and fungi.

Professional Services Automation (PSA) helps customers run their billable services business efficiently and effectively. PSA provides seamless integration between project management and time and expense tracking. Time and expenses can be entered online via laptop or Smartphone, or offline, to be synced when there is Internet connectivity. Timesheets and expense reports come with full approval routing and workflow.

Organizations that take advantage of seamless integration between Salesforce and Order Management software can achieve significant business process improvements. Gain Real-Time Visibility – The powerful reporting capabilities enable your business to manage not just fiscal but also operation performance. Easily track Key Performance Indicators (KPIs) so you can get a good handle on your business. From the General Ledger, you can easily drill down into the supporting documents behind each transaction to help you easily support accounting judgments. General Ledger is the cornerstone of the Financial Management system.

Global Consolidations provides all the functionality a company needs to manage complex, multi-entity or multi-national operations, in real time. Enable your company to expand rapidly into both local and international markets, without drastically increasing headcount. Eliminate time spent on manual processes by automating billing and payment management–and take advantage of electronic invoicing and payment capabilities that go well beyond traditional accounts payable functions.

Each category of accounting is under a separate tab (Accounts Payable, Accounts Receivable, General Journal) so it makes it easy to get to what you are trying to do. If we ever have a problem or can’t figure something out in Intacct, their customer service is always ready to help and gets back to us quickly. Intacct is an excellent cloud based accounting bookkeeping software that is easy to use and is diverse in it’s ability to be used by a wide variety of industries. Best cloud based financial solution for small and medium size organizations. Having number of options to customize the software according to the requirements, makes Intacct an appropriate solution for different types of businesses.